Forbes

Top Tech Markets And The Rent-Growth Slowdown

By: KC Sanjay

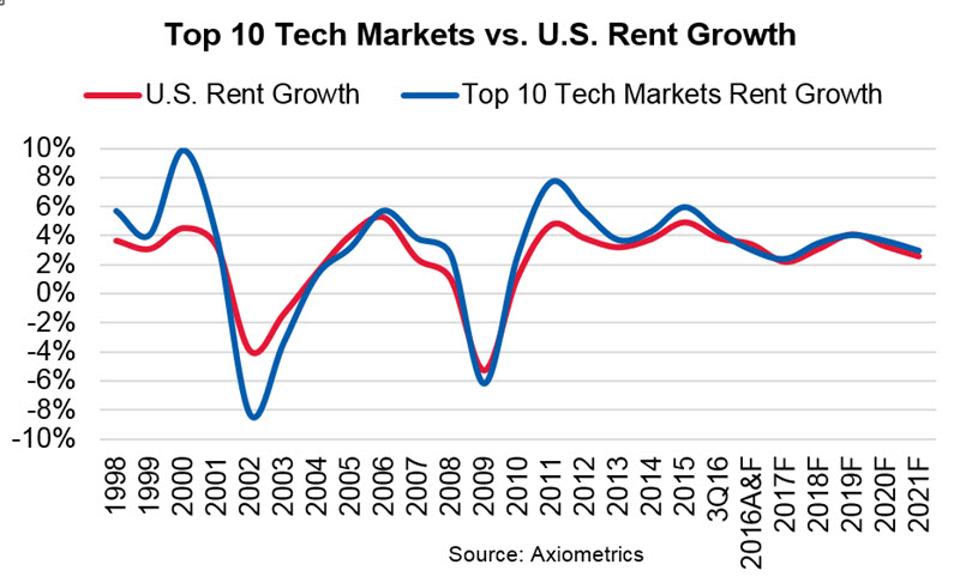

Technology centers have fueled the strong national apartment market since the great recession, with performance well above the national level. But, while these tech markets are expected to continue to outperform the rest of the country, the pace will likely simmer down a bit.

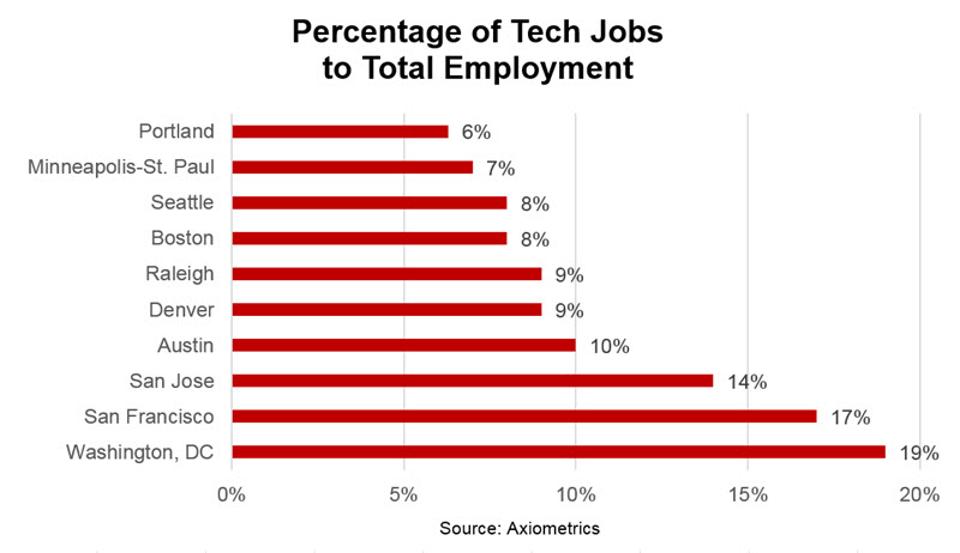

In alphabetical order, the 10 biggest tech markets are Austin; Boston; Denver; Minneapolis-St. Paul; Portland, OR; Raleigh; San Francisco; San Jose; Seattle; and Washington, DC. The job numbers are taken from the Professional, Scientific and Technical Services subsector of the Bureau of Labor Statistics’ Professional and Business Services supersector.

Combined, apartment effective rents increased 5.0% per year from 2010 through the third quarter of 2016, according to Axiometrics’ apartment data. That rate compares to the 3.6% average annual rent growth for the nation as a whole during the same period. Occupancy rates show a similar trend, averaging 95.5% in the tech markets and 94.4% in the nation since 2010.

Tech Markets Rent Growth

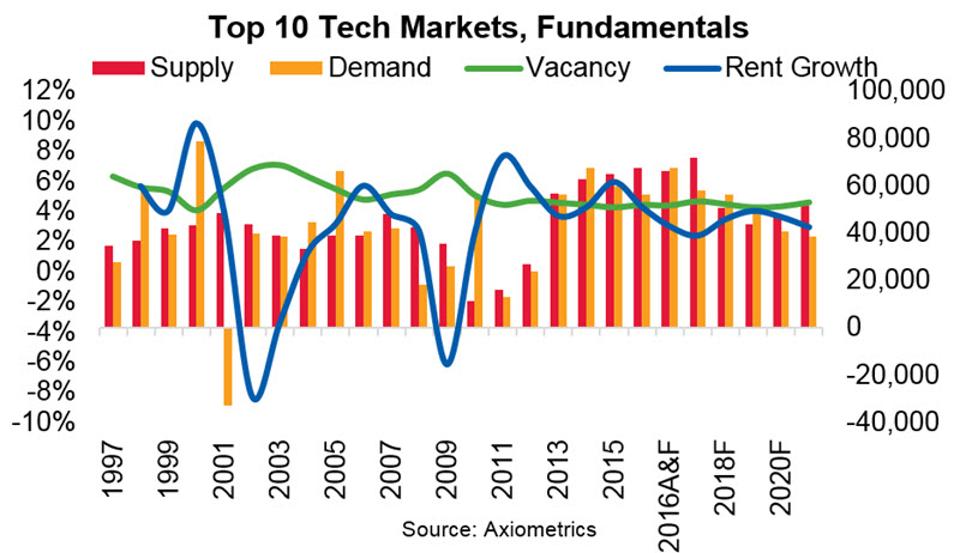

But, because apartment-market performance relies on supply and demand, the heady rent growth recorded in the tech market the past seven years are forecasted to simmer down during 2017-2021. The robust fundamentals of the post-recession era have encouraged developers to build more and more apartment properties in these metros. The amount of new supply is expected to peak in 2017 – some 71,753 new units are expected to deliver to the 10 tech markets next year – and moderate after that.

Austin, Denver, San Francisco, San Jose, Seattle and Washington have had extraordinary amounts of new supply come to market the past several years.

Top 10 Tech Markets, Fundamentals

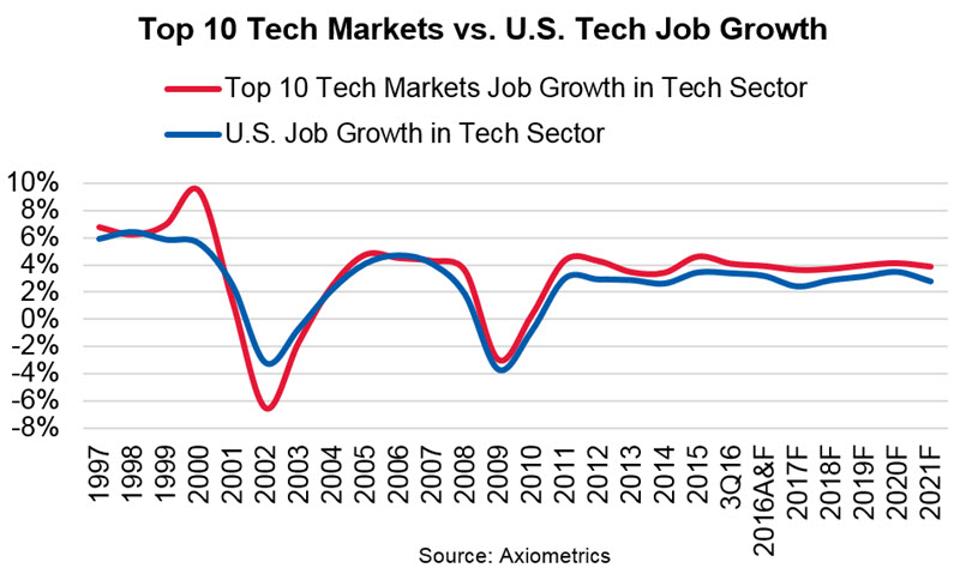

As the supply is increasing, the demand is moderating. Job growth is the primary driver of rent growth, and though the tech sector is still creating a large number of jobs, the pace of that job creation is expected to slow from an average of 4.8% in the 2010-3Q2016 time frame to about 3.8% from 2017-2021. Overall job growth has already slowed down significantly in Austin, Denver, Portland, San Francisco, San Jose and Seattle.

Tech Jobs represent a large part of the economy in these 10 markets

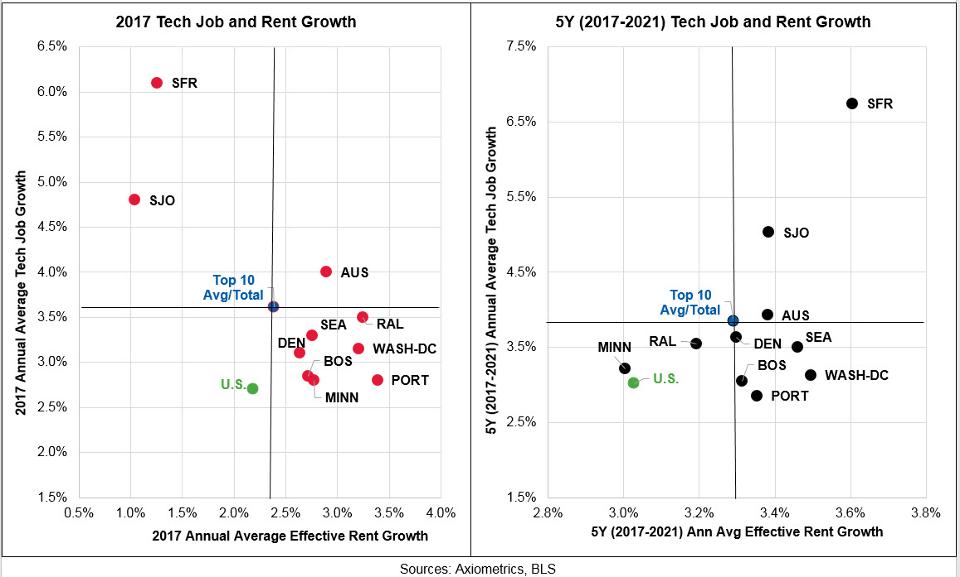

The chart below shows that the top 10 tech markets'job growth slightly outperforms the overall nation's tech sector

With those factors in mind, Axiometrics is predicting effective rents to increase by an average of 3.5% per year during the next five years, compared to 3.0% for the nation as a whole. Tech-market occupancy is forecast to remain level at 95.5%, well above the 95.0% at which Axiometrics considers a market essentially full.

Of course, each individual metro’s apartment market will respond differently during the forecast period. For example, Portland and DC are forecasted to record the highest increases in effective rent among the top 10 tech markets during 2017, while San Francisco and San Jose will likely underperform the other tech markets and the nation.

The DC area’s tech-sector job growth is still increasing, and rent growth started inching up in 2016, a trend that is expected to continue. Portland, meanwhile, is creating fewer tech jobs, but the supply-demand metrics show that some rent-growth momentum still exists – though not to the double-digit levels of 2015.

While San Francisco and San Jose rent growth is expected to be lower than usual, employers in the Silicon Valley and nearby areas are still expected to add more tech jobs than the other top tech markets both in 2017 and, along with Austin, for the entire five-year forecast period.

Despite the new tech jobs, San Francisco and San Jose supply is still peaking and these markets are extremely sensitive to overall job-growth deceleration. The evidence: the markets’ fall from double-digit rent growth to negative rent growth in the space of a year when job growth remained robust but declined slightly. That’s why rent-growth rates will continue to suffer in 2017, and will be the only tech markets to underperform the other eight tech centers and the nation next year. However, significant rebounds are expected in 2018 and beyond.

Austin is one metro in which tech job growth has fallen considerably – from an average of more than 9% from 2011-2015 to just more than 4% in 2016. Meanwhile, rent growth has averaged 3.8% in 2016, and is expected to decelerate further in 2017, after averaging almost 6% each year from 2011-2015. A glut of supply, especially in the Central submarket, has facilitated the rent-growth decline. However, like the Bay Area metros, Austin is poised to make a comeback from 2018-2021.

The other markets except Minneapolis-St. Paul and Raleigh are forecast to outperform the nation and the top 10 tech market average in both rent growth and tech-job growth. The Twin Cities and Raleigh will underperform the other tech markets, however.